NFL

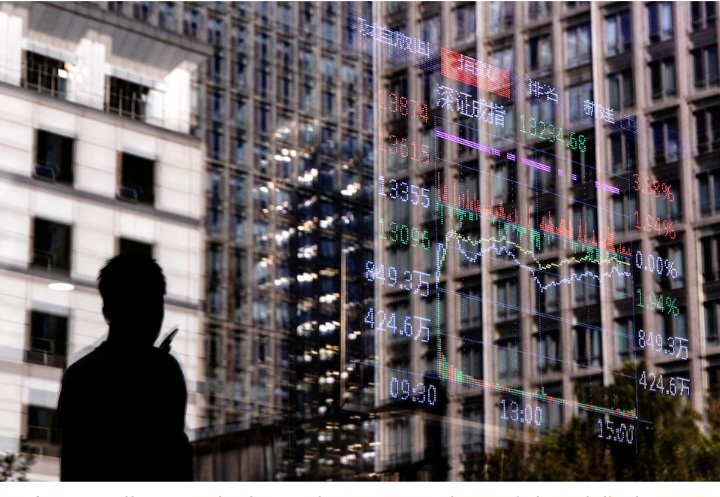

BREAKING NEWS: Global markets tumble as stocks slide and the dollar weakens, following Donald Trump’s renewed push to acquire Greenland, sparking investor uncertainty. Analysts warn of potential geopolitical tensions and trade disruptions, while financial institutions scramble to adjust portfolios. Traders face volatility, with commodities, currencies, and equities all showing erratic movements amid heightened economic anxiety worldwide.

Global financial markets experienced significant turbulence today as stock indices fell sharply and the U.S. dollar struggled to maintain its footing, following renewed comments by former President Donald Trump about acquiring Greenland. Investors reacted nervously to the geopolitical and economic implications of Trump’s proposal, which analysts say could introduce uncertainty in both international relations and global trade patterns.

On Wall Street, the Dow Jones Industrial Average dropped by 1.4%, while the S&P 500 and Nasdaq Composite declined by 1.2% and 1.7%, respectively, in early trading. European markets mirrored the U.S. slump, with London’s FTSE 100 down 1.1% and Germany’s DAX falling 1.3%, as investors grappled with the potential fallout of Trump’s statements. Analysts described the selloff as a combination of political anxiety and technical corrections, emphasizing that market confidence thrives on predictability, which Trump’s Greenland remarks disrupted.

The U.S. dollar, often seen as a safe haven during economic uncertainty, also faced pressure, weakening against major currencies including the euro and yen. The dollar index, which tracks its value against a basket of six currencies, fell by 0.6%, reaching its lowest level in two weeks. Currency strategists suggest that traders are hesitant to commit amid fears that escalating political rhetoric could impact U.S. foreign policy and trade negotiations.

Trump’s Greenland comments come amid ongoing speculation about U.S. interest in Arctic territories, particularly those rich in natural resources such as rare earth minerals, oil, and natural gas. While his proposal is not a formal government initiative, financial markets reacted as though the prospect of territorial acquisition could trigger broader international tensions. Analysts warn that if such rhetoric influences actual policy discussions, it could disrupt trade routes, affect global commodity prices, and potentially lead to sanctions or diplomatic friction with allies in Europe and Scandinavia.

“The uncertainty created by these comments is causing investors to reassess risk,” said Marissa Chen, chief market strategist at Global Capital Advisors. “When markets face political ambiguity, particularly involving foreign territories, there is a natural flight to liquidity, but ironically, we are seeing weakness in both equities and the dollar simultaneously, which is unusual.”

Commodity markets also experienced volatility. Oil prices saw moderate gains due to speculation that Arctic resource exploration could intensify, while gold rose modestly as traders sought safe-haven assets. The bond market showed signs of nervousness, with U.S. Treasury yields declining slightly as demand for safer investments increased.

Financial institutions worldwide are reportedly reviewing exposure to sectors that could be affected by potential geopolitical changes, including shipping, energy, and defense. Analysts caution that even rhetoric not immediately translated into policy can impact investor confidence and market stability. “Markets respond not just to facts but to perception and expectation,” noted Jonathan Reyes, senior economist at Horizon Financial. “Trump’s Greenland comments, regardless of feasibility, have injected a level of uncertainty that markets are highly sensitive to.”

In addition to economic concerns, the statement has also sparked political reactions internationally. Danish officials, whose country governs Greenland, have reiterated that the territory is not for sale and expressed confidence in defending national sovereignty. European diplomats have urged calm, emphasizing dialogue and international law. However, the continued media attention surrounding the topic keeps investors wary, feeding into market fluctuations.

U.S. consumers and businesses are also feeling indirect effects, with a modest uptick in borrowing costs as yields on short-term U.S. debt adjust to investor caution. Corporate executives report hesitancy in committing to long-term investments or expansion projects, citing market unpredictability as a concern. Small and mid-size enterprises dependent on imports and exports are particularly vulnerable, given potential shifts in trade policies.

While some analysts describe today’s market moves as a temporary reaction, others caution that sustained volatility could persist if political rhetoric continues to dominate headlines. Historical patterns suggest that markets often overreact to geopolitical statements, but repeated commentary can lead to lasting risk premiums and reduced investment confidence.

For now, investors are advised to maintain diversified portfolios, closely monitor news developments, and prepare for further swings in both stock and currency markets. Traders are also keeping a close eye on central bank communications, as any adjustments in monetary policy could exacerbate or mitigate market reactions.

Ultimately, today’s market turmoil underscores the interconnected nature of global finance, where political statements—even those outside formal government action—can ripple across equities, currencies, and commodities, influencing investor sentiment worldwide. As the story unfolds, both Wall Street and global markets remain on alert, reflecting the delicate balance between political discourse and economic stability.